Berkshire Hathaway’s Secret Position

Warren Buffett’s Berkshire Hathaway (BRK.B) released their third quarter 13F regulatory in November. It included a the footnote which read “Confidential information has been omitted from the public Form 13F report and filed separately with the US Securities and Exchange Commission”

This has lead to speculation on what this mystery business that Berkshire is accumulating a position in could be.

This is not the first time Berkshire has had such omissions in their filings, and was seen as recently as 2015 when Berkshire was building a position in Phillips 66.

What we know

Warren Buffet loves the insurance, banking and lending industry. Up until recently, Berkshire Hathaway has been the largest shareholder of Wells Fargo. Over the past year they’ve been scaling back out of their position as the pandemic took a hard hit on the banking industry - and previous troubles at Wells Fargo, caused an even larger pullback for the bank than many of its peers. One noteworthy aspect of Wells Fargo business is they are the second-largest US home mortgage lender. The largest mortgage lender since 2018, has been Quicken Loans (RKT). Given that Berkshire owns the majority of the national’s largest residential real estate brokerages, HomeServices of America, it would make sense to have a strategic partnership or investment with a large mortgage lender like Rocket.

There are reports from previous years that link Warren Buffett and Dan Gilbert, the co-founder of Quicken Loans, today a subsidiary of Rocket Companies (RKT). A Fortune article from 2016 mentions “an exclusive mortgage-purchasing agreement between Quicken and a subsidiary of Buffett’s conglomerate Berkshire Hathaway (BRK-A)”. In an interview with CNBC, Buffett has said “”I’m an enormous admirer of Dan and what he has accomplished in Quicken Loans”. There have also been talks in previous years of the two partnering up to buy Yahoo. While we don’t have much details on their exact business dealings, there is evidence that there has been at least some level of talks and mutual admiration for years between the two men and their companies.

On November 11th 2020, Jay Farner, the CEO of Rocket Companies in an interview with CNBC’s Jim Cramer mentioned of an upcoming partnership with a “major large financial institution” that would be announced next year. Berkshire Hathaway would certainty fit the bill.

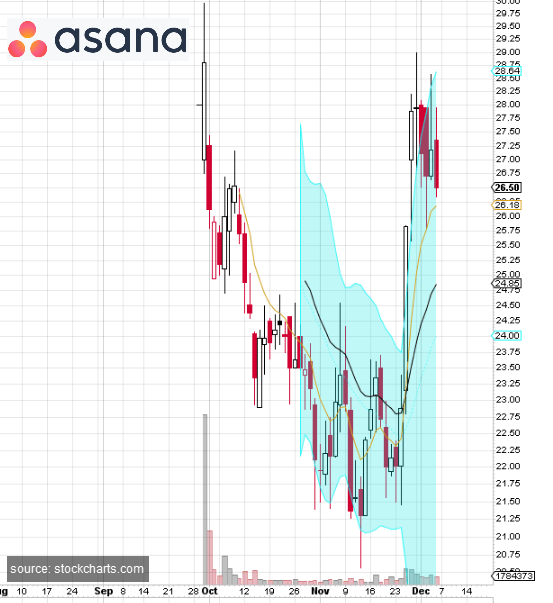

Rocket Companies

Rocket Companies (RKT) was founded in 1985 by Dan Gilbert, Lindsay Gross, Gary Gilbert originally named Rock Financial, later renamed to Quicken Loans. In 1999, Intuit, the makers of Quicken, QuickBooks and Turbotax, bought Rock Financial. A few years later Dan Gilbert and a group of private investors bought back the Quicken Loans subsidiary back from Intuit - but is why Intuit still retains products that share the “Quicken” name.

In 2016 Quicken Loans launched Rocket Mortgage which was the first fully online mortgage lender.

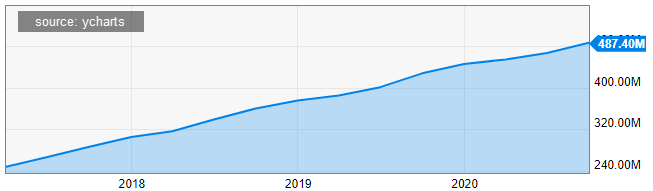

In the summer of 2020, the company was taken public, though the public float include just only a fraction of the overall shares. As of this writing, the market cap is 41.396B

This site references only our opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. Disclosure: we are long RKT and BRK.B stock and RKT March $20 calls.