Growing Returns AND Multiples on Mega Cap Tech

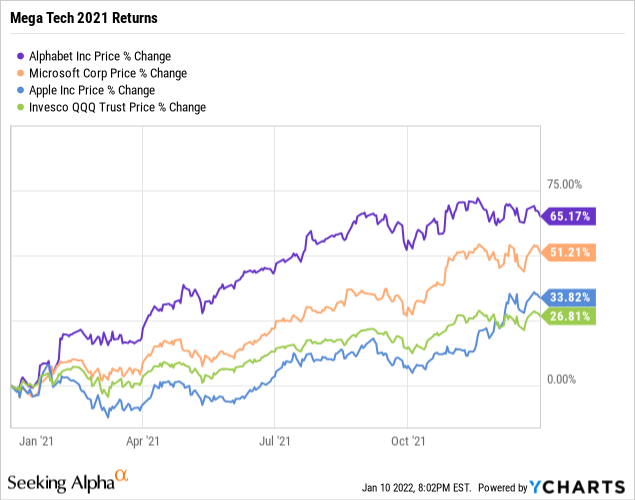

While Nasdaq 100 (QQQ), has had some recent pullbacks, 2021 was a great year for the large-cap tech stocks which have grown by an immense amount over the year. With the rising interest rates, and a more hawkish Fed some investors are looking to reposition to perceived safer sectors in the current environment. In recent history, FAAMG/FANG mega-cap tech has proved itself as a safer, and lucrative place to have your money in recent history — but will it continue in the current climate? Let’s take a look.

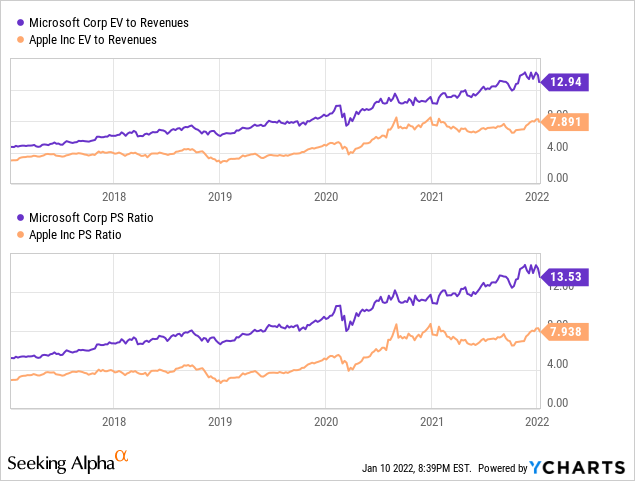

While the mega-tech stocks had extremely impressive revenue and earnings growth, their multiples have also expanded to near historic highs. And though this can be justified by higher growth rates, and within the context of higher overall market multiples, those who are worried about compressing multiple environments due to inflation, and rising Treasury yield, may want to look at another area of the market which is potentially offering a rare opportunity.

While revenue has undoubtedly grown, the valuations have grown unproportionally and these stocks are trading at multiples not seen in 20 years. If stock multiples contract, these have a long way down to go.

Hidden Value

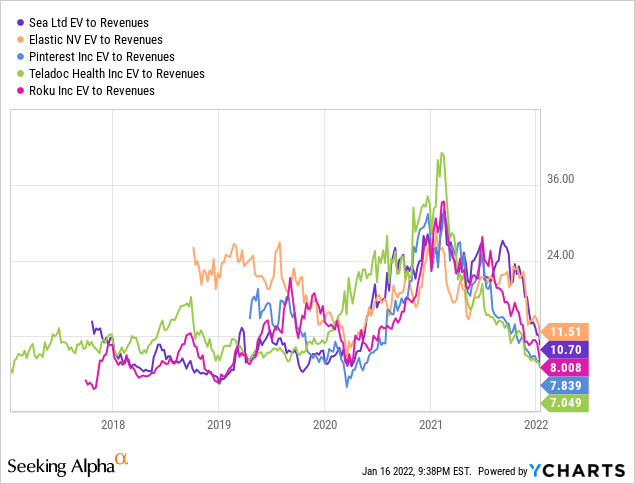

Unlike the S&P500 and Nasdaq 100, small to mid-cap growth has been in a bear market since February 2021 — not something one would gather by looking purely at the major averages, largely because of the tilted weightings of the mega cap giants we mentioned previously. Many smaller, mid cap growth stocks peaked in February or November 2021, and are 50% or more from their highs. Of course federal stimulus, a retail frenzy in the market, and stocks priced for a never-ending pandemic likely caused many of the stocks in this cohort to climb to unjust elevations which some may never see again. However, the recent selling pressure in this area of the market has been nearly indiscriminate while the underlying businesses, are all very different, with distinct prospects and valuations. We believe this presents long term investors a great opportunity to individually examine specific stocks that are trading at historically low multiples to find great opportunities. Certainly some of the names will not be great companies with sound fundamentals, but companies like Sea Limited (SE), Teladoc (TDOC), Block (SQ), Elastic (ESTC) remain as strong as ever, with growing revenues, sound fundamentals and historically low multiples and this may be a great time to add to or start positions in some of theses names.

Taking a look at a few high-growth stocks which have had massive stock price appreciation over the past two years, but have also had massive falls in recent months, we see that their EV/revenue multiples have sharply contracted and are now trading at or below pre-pandemic levels. While we shouldn’t think that earlier, at their highest prices and multiple is their “true value”, it’s unlikely that many of these companies, who have secular growth drivers, and accelerating revenue growth rates, will stay at their lowest 5 year multiples either.

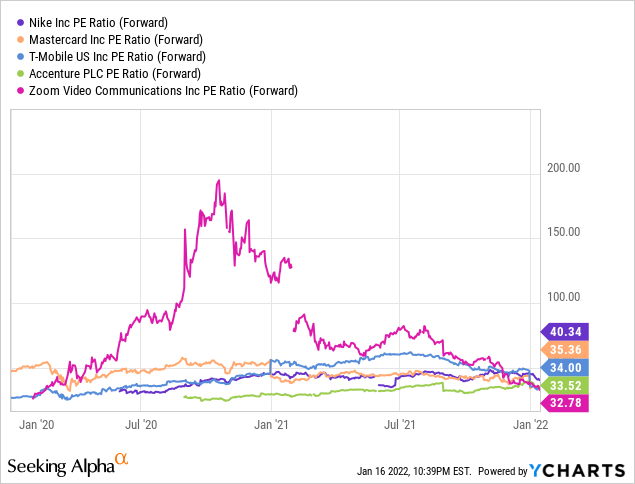

While each of the above stocks have different businesses and fundamentals which we urge investors to look at individually, there is likely an opportunity, as many great, growing companies have been discarded with the sector as a whole. One of the most egregious examples of pandemic stocks that grew to wild valuation and has since drastically corrected in Zoom (ZM). It along with Peloton (PTON) have been the notorious poster child for the “stay at home stocks”. In addition to the recent sector sell-off, Peloton has been hurt by disappointing earnings results, making some on Wall Street question the soundness of the business. Zoom, on the other hand, is a profitable business with a great balance sheet and while it’s lack of optionality may rightfully concern some investors, whose stock has been recently beaten down with the same exuberance it was propelled to wild valuation at the start of 2021. And while valuing growth companies we usually look at revenue multiples, but with Zoom being profitable we can look at PE ratio — and with all of the recent negative sentiment around valuation, it may surprise many that at these recent heavily depressed levels Zoom has a forward PE lower than some traditional S&P companies.

This site references only our opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. Disclaimer: We own some of the securities mentioned and may open more positions within 24 hours.